If you were prevented from filing, you can submit the form with your paper tax return if someone else has already filed a return using your SSN. If your return was rejected due to someone claiming your dependent’s social security number, you will need to file a separate Form for them. You will not be able to file electronically and will need to submit a paper return. If fraud is suspected during processing, the IRS will contact you via mail with instructions.

Due to their nature, most crimes committed using a stolen SSN fall under identity theft. If your Social Security number has been breached, it opens the gateway to accessing other personal information related to you. Your phone number, email address, place of residence, credit and debit card information — anything is (un)fair play. The company will then share the information with the other two credit reporting companies and add an alert to your file.

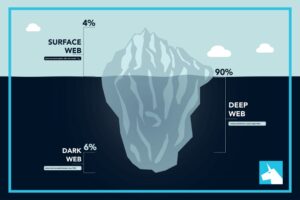

Risks Associated With Having Your SSN On The Dark Web

Or you get a call from a lender threatening repossession of a luxury car that you don’t own. As alarming as these scenarios may seem, they are signs of a surprisingly common crime — identity theft. Discovering that your Social Security number is on the dark web is a frightening experience, but taking immediate action can help minimize the risks. By staying vigilant, taking protective measures, and seeking professional assistance if necessary, you can safeguard your identity and financial well-being.

Sign Up For MyE-Verify, And “self-lock” Your SSN

Even if you take steps to protect your credit, it’s important to keep a close eye on your existing accounts—including your bank account, credit card statements, and utility bills. You’ll need to request a credit freeze from each of the three major credit bureaus individually — Experian, Equifax, and TransUnion. They will each ask for personal data and provide a secret PIN to freeze or “thaw” your file when needed. You’ve likely never heard of National Public Data, the company that makes its money by collecting and selling access to your personal data to credit card companies, employers, and private investigators. It now appears that the hacker group USDoD snatched about 2.9 billion of its records. Odds are that your records — including, possibly, your Social Security number (SSN) — are in those databases.

Who Should File Form 14039?

- If your SSN has been compromised, it’s only a matter of time before your identity is stolen.

- While it’s impossible to eliminate the threat of cybercrime entirely, taking these steps will make it much harder for cybercriminals to access and misuse your data.

- Act swiftly to ensure that necessary investigations can be carried out and appropriate measures can be taken to safeguard your personal information.

- Identity theft protection services can provide continuous monitoring of credit, public records, and the dark web for compromised information.

- Even if law enforcement is able to take down a marketplace that’s selling your information, cybercriminals can simply upload it somewhere else.

- Criminals can use this information in a variety of ways, such as impersonating you, creating a fake identity, opening credit accounts in your name or getting a medical procedure using your insurance.

However, this is a difficult process, and a new SSN won’t necessarily solve all the problems related to identity theft. It warns that by searching on its tool, you agree to its terms of service and its privacy policy. The suits claim as many as 2.9 billion people — that’s right, billion with a “B” — may have been affected, while other officials have said the number is in the millions. While the exact number is unclear, what we do know is that we should all take steps to protect ourselves. One such service is how Hofmann, who filed the lawsuit, found out that his information has been leaked as part of NPD breach. There are many similar companies that scrape public data to create files on consumers, which they then sell to other businesses, Steinhauer said.

Verify through reputable sources such as credit monitoring services, your bank, or services provided by government agencies like the Federal Trade Commission (FTC). With a credit freeze, the credit bureaus won’t release your information if a bank or other lender asks to see your report. And no lender will open a new account without first getting a look at your report.

Data breaches happen daily and no matter the precautions, there’s no guarantee your private information is safe. Having your Social Security Number (SSN) on the dark web can have several consequences. Given its secretive nature, it can be difficult to know if your information has been compromised and is being shared on the dark web. Even if you take all the necessary precautions, it’s important to stay vigilant about protecting your Social Security number. Identity thieves can also steal your information by accessing your computer or mobile device. That’s why it’s important to have security software installed and to keep it up-to-date.

Strengthen Your Online Security

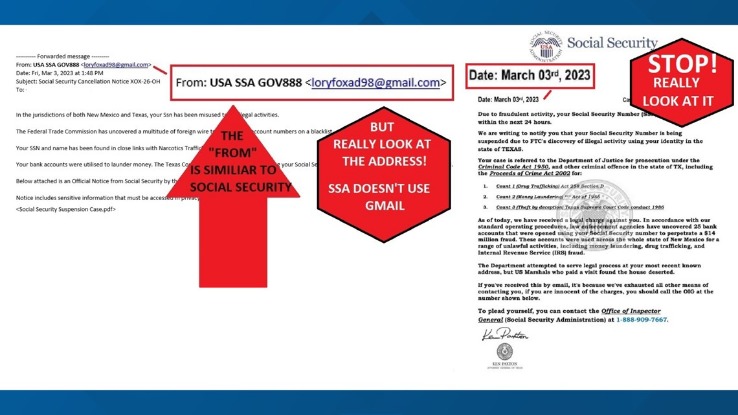

You can also report the theft to the Social Security Administration (SSA) and the Federal Trade Commission (FTC). These organizations can provide guidance on what to do next, and your report may contribute to future investigations of fraudulent activity. Join LifeLock Standard to monitor the dark web for your SSN and get alerts of potential fraud. Being proactive is one of the best ways to protect your child’s personal information and identity. Here a few things you can do to help secure your family’s personal information. An FTC report won’t clear any issues on its own, but it can be an important resource when working to resolve any issues with creditors or the credit bureaus later on.

Is It Worthwhile To Pay For Extra Protection?

Remember, your Social Security number is a crucial part of your identity, but it doesn’t define you. With the right approach and resources, you can overcome this challenge and emerge with stronger, more secure personal information management practices. Stay vigilant, stay informed, and take control of your digital identity. While the steps outlined in this guide can seem overwhelming, tackling them one at a time will help you regain control over your personal information and financial security. Don’t hesitate to seek professional help if you feel overwhelmed or encounter complex issues. However, it’s important to note that while they can be helpful, they don’t guarantee complete protection.

The company added that it is working with law enforcement and government investigators. NPD said it “will try to notify you if there are further significant developments applicable to you.” Angela’s expertise is grounded in a passion for staying at the forefront of emerging threats and protective measures. Her commitment to empowering individuals and organizations with the tools and insights to safeguard their digital presence is unwavering. In today’s digital age, identity theft and cybercrime have become increasingly prevalent threats.

Introduction To X-Torrent: The Future Of P2P File Sharing

Beyond credit protection, immediately change passwords for all online accounts, especially financial, email, and social media accounts. Use strong, unique passwords for each account and enable two-factor authentication (2FA) wherever possible. This adds an extra layer of security, requiring a second verification, like a code sent to your phone. You can also consider placing a fraud alert on your credit reports, which requires businesses to verify your identity before issuing new credit in your name.

How To Protect Your SSN From Future Exposure

This is why it’s important to report your SSN as stolen right away, so the FTC can collaborate with law enforcement to help you achieve justice. If you don’t already have a mySocialSecurity account, you need to create one so you can view and manage your benefits, application status, earnings and statements. It is important to create and monitor your mySocialSecurity account so you can detect any discrepancies and signs of identity theft. After creating your mySocialSecurity account, immediately report any unusual activity to the SSA.

There is little you can do if your child’s email is floating around the web other than having them create a new email address and educating them on how to stay protected from email scams. Once they take control of your number, they can have your text message MFA codes sent to a phone they control. The potential for porting and SIM swapping is why SMS-based MFA can be less secure than other options. If you have the option to turn it on, you also might be able to choose your additional form of authentication. In general, text message and email MFA are the least secure options, but they’re still better than nothing.

How To Take Action When Your Child’s Identity Is Stolen

The background check company, which is owned by Jerico Pictures Inc., recently released details of the breach after a proposed class action lawsuit alleged 2.9 billion personal records may have been exposed. Other reports suggest the amount of records leaked may have been more than 2.7 billion. Many companies offer credit monitoring plans that help combat credit-card hacking. For example, AAA offers ProtectMyID, a complementary credit monitoring service for all AAA members. Signing up for a credit monitoring service can help you keep your identify safe, while giving you peace of mind. Having your Social Security number on the dark web leaves you vulnerable to identify theft.

This will notify creditors that you may be a victim of identity theft and make it more difficult for thieves to open new accounts in your name. One of the lesser known ways that scammers target you is by convincing your phone provider to send them a new SIM for your account. Known as a “SIM swap,” this scam gives fraudsters full access to your phone number — which means all calls and texts go to them, including 2FA codes and password reset links. If you think or know your SSN was leaked to the Dark Web, you can take steps to minimize the damage and protect yourself from identity theft and fraud.