This category, known as Dumps on the dark web, encompasses the raw magnetic strip data of credit cards. It includes critical information such as the bank account number, account balance, service code, PIN code, and card verification code. These details are primarily sought for physical use, enabling activities such as cash withdrawals from ATMs.

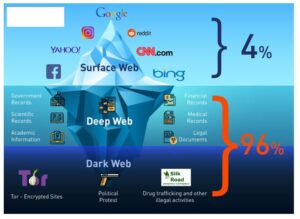

Monitoring The Dark Web

2 Next, we’ll look at how credit card info ends up on the dark web. Card Shops typically host the trade of credit cards and other stolen financial information, making it easy for cybercriminals to find what they’re looking for. Regularly monitoring your credit card statements can help you detect any suspicious activity, such as unauthorized transactions. Stolen credit card details can be categorized into different types, making it easier for cybercriminals to exploit them. The credit card details of millions of people are being sold to criminals on the dark web for an average of less than £8 ($10.60) each.

For more than 17 years, John covered a wide variety of topics including network security and enterprise technology for The Register. His work at The Register earned him a number of awards, including the BT Enigma award for contributions to technology journalism. It’s believed that the passwords were stored as SHA-1 hashes of the first 10 characters of the password converted to lowercase. “The sheer volume and diversity of data types in this leak suggests that this was likely a centralized aggregation point, potentially maintained for surveillance, profiling, or data enrichment purposes,” the researchers concluded.

Thursday: Pok�mon Legends: Z-A – Reveal Trailer + Pok�mon Caf� ReMix – Bewear’s Festival

Card data is a hot commodity on the dark web, with credit card details and cloned cards being sold to cybercriminals. These stolen cards can be used for financial gain through unauthorized charges, account takeover, and identity theft. Since Real and Rare serves vendors as well as consumers, it offers its users a referral program that provides them with their own personal referral URLs, which they can hand to new users and get a 10% commission for every purchase they make. This is how the site admins encourage users to post their stolen credit card details on their site first. The cost of credit monitoring services depends on the company and level of features but often ranges between $7 and $40 per month for individual plans.

VPN Alternatives For Securing Remote Network Access

Anyone who uses credit cards for daily purchases should monitor for exposure to protect against fraudulent transactions and unauthorized access. Exposure of your credit card details can lead to fraudulent activity, which could negatively impact your credit score. Implementing a 3-D Secure ACS solution, like Outseer 3-D Secure, fortifies the fraud prevention strategy. This EMV® 3-D Secure ACS delivers a secure, frictionless digital shopping experience, providing a multi-layered defence against unauthorized transactions. By adding an extra layer of authentication, financial institutions reduce the risk of fraudulent activities during transactions. This proven technology, seamlessly working in the background, analyses transaction data and authenticates users in real-time, ensuring only legitimate transactions proceed.

Hubble By The Numbers

The three suspects from Indonesia confessed to stealing payment card data using the GetBilling JS-sniffer family. The cards were likely compromised online, using phishing, malware, or JavaScript-sniffers, which are increasingly popular among cybercriminals. The data posted on these online illicit shops is a goldmine for threat actors who are looking to commit financial crimes. It provides them with valuable information needed to carry out a variety of attacks. Although it offers leaks from many different countries, the site has a dedicated lookup and leak section for Canadian profiles, making it extremely easy to use for buyers interested in Canadian leaks.

Explore Offers

All of this has made it one of the most reliable markets still active in 2025. The repercussions of dark web credit card marketplaces, including the rise and fall of Joker’s Stash, extend beyond monetary losses. Financial institutions shoulder increased operational costs tied to investigating fraudulent activities and failed authentication attempts. Customers who lose their card data to fraud may turn to a different card while waiting for a replacement card, threatening the top-card effect of passing all spending across one preferred card.

Reshaping Our Cosmic View: Hubble Science Highlights

Payment information moves through a series of specialized dark web markets. Experience Flare for yourself and see why Flare is used by organization’s including federal law enforcement, Fortune 50, financial institutions, and software startups. Cyberthreats are constantly evolving, and your security measures should be continuously updated as well. The payment information is then posted for sale on the dark web where other threat actors can purchase and use it. Alex Herrick is a seasoned web designer and digital strategist with over a decade of experience in the industry.

National Public Data

- The DoJ stated at the time that Ngo had made a total of $2 million from selling personal data.

- Learn how to automate financial risk reports using AI and news data with this guide for product managers, featuring tools from Webz.io and OpenAI.

- While credit monitoring can alert you to fraud and help restore your credit, it doesn’t automatically come with identity theft protection.

- Payment information moves through a series of specialized dark web markets.

For example, if you’re already a victim of identity theft, choose a company that monitors all three of the major credit bureaus. Likewise, select a provider that offers high identity theft insurance coverage and additional features like dark web scanning. Carding shops are a type of dark web marketplace that hosts the trade of credit cards and other stolen financial information. These platforms serve as hubs for cybercriminals to buy and sell compromised payment card details.

Ready To Explore Web Data At Scale?

IdentityForce’s triple-bureau credit monitoring and extensive identity protection tools make it a top choice for consumers who want comprehensive features. The credit score provided in CreditWise is a FICO® Score 8 based on TransUnion data. The FICO Score 8 gives you a good sense of your credit health but it may not be the same score model used by your lender or creditor.

However, there have been instances when credit monitoring for those two companies doesn’t start during your trial period. You may cancel your trial membership in Experian IdentityWorksSM at any time within seven days of enrollment without being charged. A credit card is required to start your free seven-day trial membership. You may cancel your trial membership at any time within seven days without charge. If you decide not to cancel, your membership will continue, and you will be billed for each month that you continue your membership. The data backing this service is not a table of card number prefixes.

Current Moon Phase: August 29, 2025

Criminals can use this information in a variety of ways, such as impersonating you, creating a fake identity, opening credit accounts in your name or getting a medical procedure using your insurance. To freeze your credit, you need to contact each of the three major credit bureaus individually — Experian, Equifax, and TransUnion. To check for more sensitive leaked information — such as your Social Security number (SSN), phone number, or scans of your physical IDs — you need to sign up for a dedicated Dark Web monitoring service.